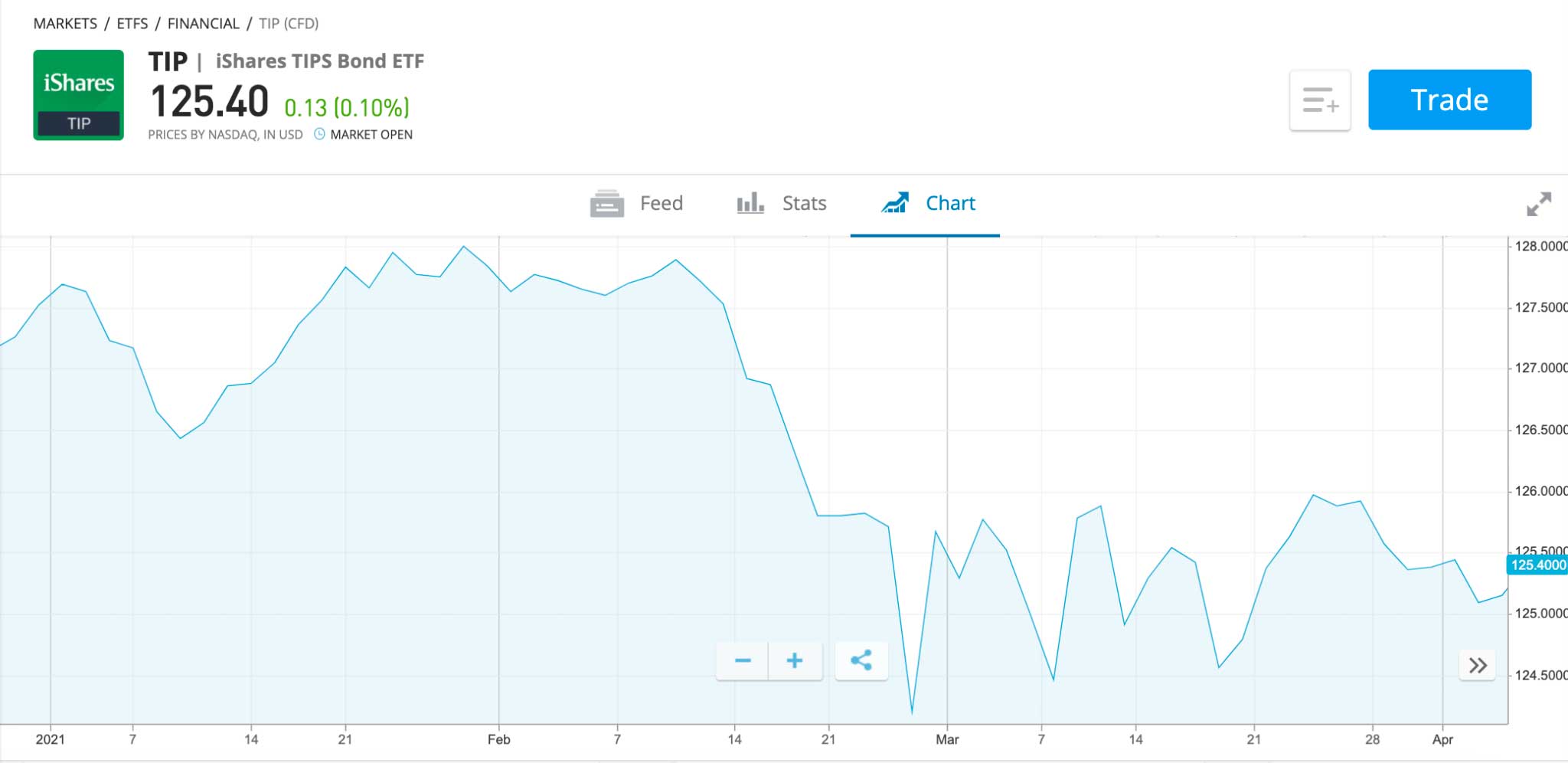

The overall market for fixed income mutual funds is $4.5 trillion, and 78% of those assets are actively managed, showing a preference for active management of fixed income mutual fund assets.¹ ETFs in comparison, while increasingly popular, have only $1.5 trillion in assets under management and $176 billion in active fixed income ETFs — despite the preference for active management in the.. The fixed-income exchange-traded funds on this list earn Morningstar's top rating in 2024. Tori Brovet Feb 14, 2024. Share. Do investors need bonds in their portfolios? The question is a.

Fixed Funds Complete guide on Fixed Funds

PPT The South African and Global Landscape of Exchange Traded Funds (ETFs) PowerPoint

Standardizing a Growing Fixed ETF Market Bloomberg L.P.

Exchange Traded Funds Definition & Explained with Examples. Essentials of Investments YouTube

:max_bytes(150000):strip_icc()/Exchange-TradedMutualFundETMF-asp-v1-9b3b2ff66aad48f0b88dd41ac20c7b9e.jpg)

ExchangeTraded Mutual Fund (ETMF) What It is, How it Works

Investing In Exchange Traded Funds Skill Success

Understanding and Navigating Fixed Securities (2023)

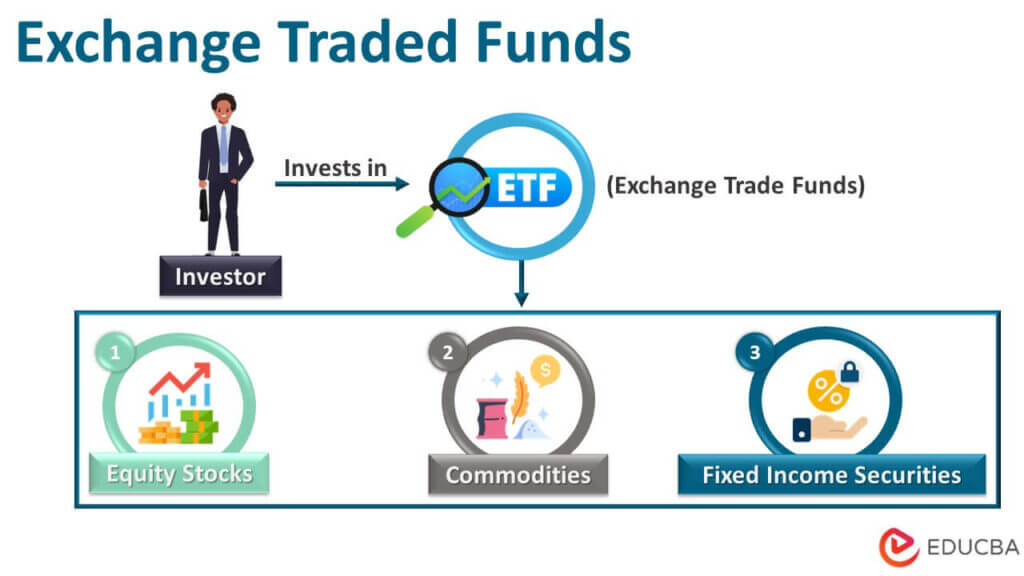

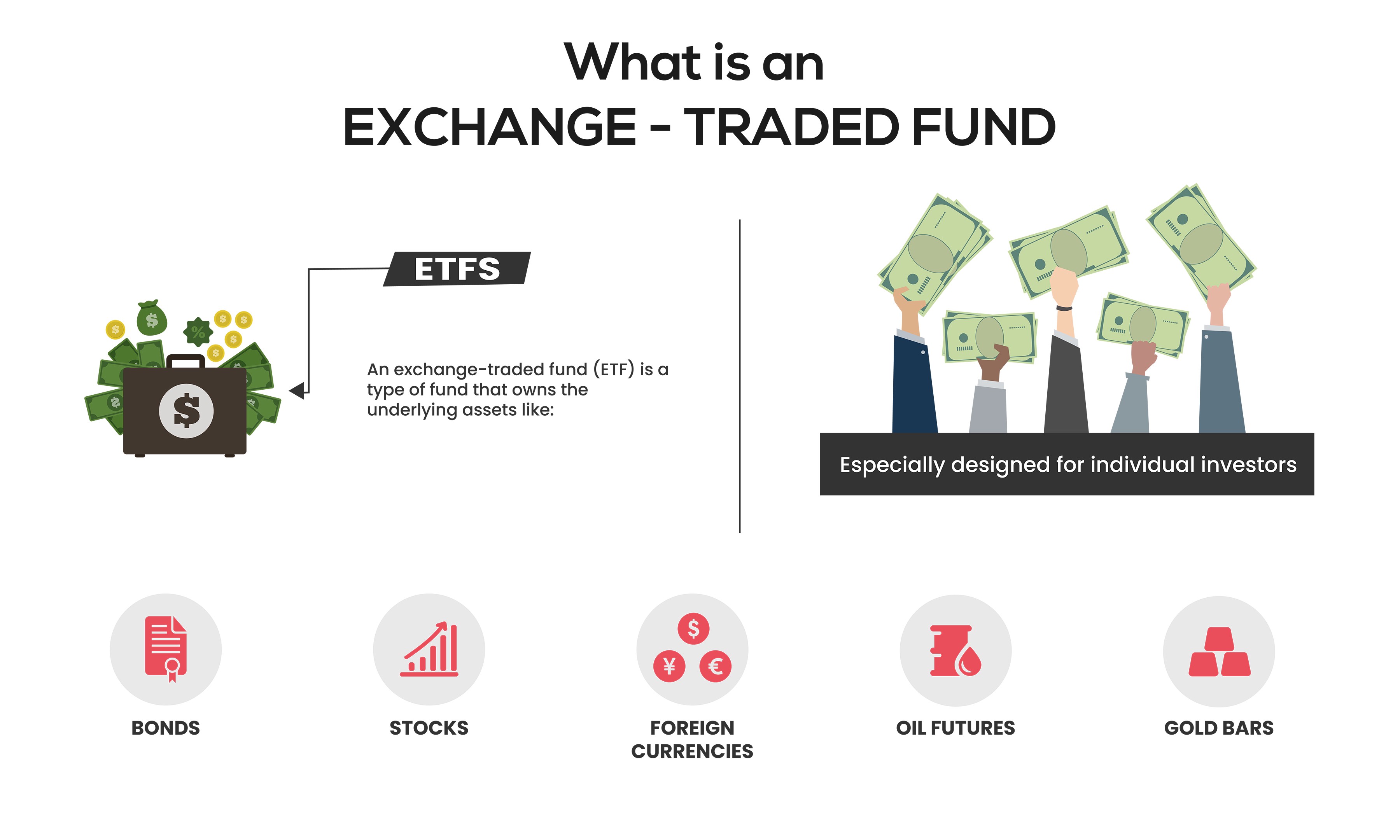

Exchangetraded Funds Most ETFs track an index, such as a stock index or bond index. Stock

Exchange Traded Funds How Does It Work with Example & Types?

Clear Path Analysis Fixed Exchange Traded Funds Demand, APAC 2020 Report

What is Exchange Traded Funds (ETFs)? Money Cash Hos

Fresh Graduates’ Employer Preferences What Should You Do as an Employer?

Best Fixed Funds UK to Watch in October 2023

Understanding ExchangeTraded Funds

An Overview of Fixed Investments AlgoBulls Blog Site

Understanding ExchangeTraded Funds Financial Initiatives Counsel

Getting Started What Are Exchange Traded Funds (ETFs)? The Smart Investor

What are Exchange Traded Funds? Who should invest in ETFs?

Advantages of ETFs over Mutual Funds WealthDesk

Fixed Trading What It Is, Plus Interview & Career Guide

One of the most interesting developments in recent years is the explosive growth in fixed income ETFs and assets under management. Assets in fixed income ETFs rose 900% and the number of funds was up 326% from 2009 to 2014, crossing the $500 billion mark in October 2015. 1 Fixed income ETFs are portfolios of cash bonds increasingly used by institutional and retail investors to gain quick.. Two of the new ETFs, classified as Article 9 under EU SFDR, will invest in green bonds and support the transition to a low-carbon future; London, 31 October 2023 - Franklin Templeton 1 is pleased to announce the launch of three new active fixed income ETFs - Franklin Sustainable Euro Green Sovereign UCITS ETF, Franklin Sustainable Euro Green Corp 1-5 Year UCITS ETF and Franklin Euro IG.